How To Calculate Property Taxes In South Carolina . This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. beaufort county property tax calculator. here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. Property tax is administered and collected by local governments, with assistance from the. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. the amount of property tax due is based upon three elements: to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. (1) the property value, (2) the assessment ratio applicable to the.

from www.city-data.com

our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. beaufort county property tax calculator. the amount of property tax due is based upon three elements: (1) the property value, (2) the assessment ratio applicable to the. This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. Property tax is administered and collected by local governments, with assistance from the.

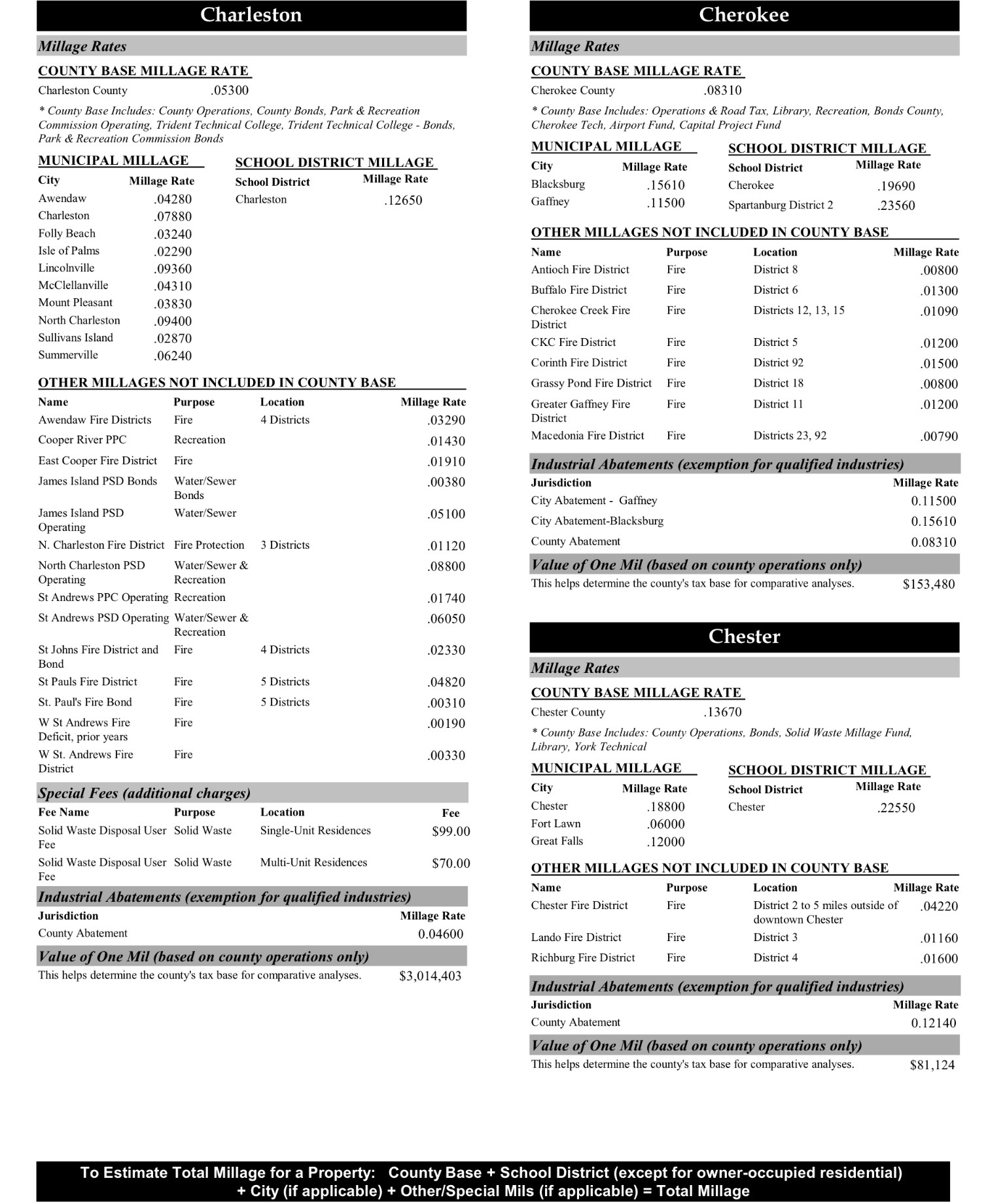

Vehicle property tax calculation (Charleston assess, estimator, county

How To Calculate Property Taxes In South Carolina to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Property tax is administered and collected by local governments, with assistance from the. beaufort county property tax calculator. the amount of property tax due is based upon three elements: This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. (1) the property value, (2) the assessment ratio applicable to the. here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your.

From www.crgcompaniesinc.com

Property Taxes South Carolina Ranked 7th Lowest In The Country How To Calculate Property Taxes In South Carolina our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. the amount of property tax due is based upon three elements: Property tax is administered and collected by local governments, with assistance from the. to calculate the exact amount of property tax you will owe requires your. How To Calculate Property Taxes In South Carolina.

From www.charlestonrealestate-nikkidumin.com

Tips to Learning about South Carolina Property Taxes — Charleston Real How To Calculate Property Taxes In South Carolina beaufort county property tax calculator. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. the amount of property tax due is. How To Calculate Property Taxes In South Carolina.

From oysterlink.com

South Carolina Paycheck Calculator Calculate Your Net Pay How To Calculate Property Taxes In South Carolina the amount of property tax due is based upon three elements: (1) the property value, (2) the assessment ratio applicable to the. beaufort county property tax calculator. here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. Property tax is administered and collected by local governments, with. How To Calculate Property Taxes In South Carolina.

From calculator-online.info

South Carolina Sales Tax Calculator State, County & Local Rates How To Calculate Property Taxes In South Carolina the amount of property tax due is based upon three elements: This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. Property tax is administered and collected by local governments, with assistance from the. our south carolina property tax calculator can estimate your property taxes based on similar. How To Calculate Property Taxes In South Carolina.

From www.youtube.com

How To REALLY Save on South Carolina Property Taxes YouTube How To Calculate Property Taxes In South Carolina (1) the property value, (2) the assessment ratio applicable to the. here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. beaufort county property tax calculator. Web. How To Calculate Property Taxes In South Carolina.

From www.ezhomesearch.com

Ultimate Guide to Understanding South Carolina Property Taxes How To Calculate Property Taxes In South Carolina to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. beaufort county property tax calculator. Property tax is administered and collected by local governments, with assistance from the. This estimator is designed to give the taxpayer or prospective buyer an estimate of property. How To Calculate Property Taxes In South Carolina.

From www.youtube.com

How to Calculate Property Tax Prorations Ask the Instructor YouTube How To Calculate Property Taxes In South Carolina Property tax is administered and collected by local governments, with assistance from the. (1) the property value, (2) the assessment ratio applicable to the. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. the amount of property tax due is based upon three elements: This estimator is. How To Calculate Property Taxes In South Carolina.

From www.city-data.com

Vehicle property tax calculation (Charleston assess, estimator, county How To Calculate Property Taxes In South Carolina our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. the amount of property tax due is based upon three elements: beaufort county property tax calculator. Web. How To Calculate Property Taxes In South Carolina.

From rfa.sc.gov

Property Tax Reports South Carolina Revenue and Fiscal Affairs Office How To Calculate Property Taxes In South Carolina (1) the property value, (2) the assessment ratio applicable to the. beaufort county property tax calculator. here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. Web. How To Calculate Property Taxes In South Carolina.

From www.youtube.com

How To AVOID Paying To Much For Property Taxes? South Carolina Real How To Calculate Property Taxes In South Carolina to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. beaufort county property tax calculator. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. This estimator is designed to give the. How To Calculate Property Taxes In South Carolina.

From www.wikihow.com

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow How To Calculate Property Taxes In South Carolina beaufort county property tax calculator. (1) the property value, (2) the assessment ratio applicable to the. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for. How To Calculate Property Taxes In South Carolina.

From www.ownerly.com

How to Calculate Property Tax Ownerly How To Calculate Property Taxes In South Carolina to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Property tax is administered and collected by local governments, with assistance from the. the amount of property tax due is based upon three elements: here are the typical tax rates for a. How To Calculate Property Taxes In South Carolina.

From www.wikihow.com

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow How To Calculate Property Taxes In South Carolina here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. beaufort county property tax calculator. Property tax is administered and collected by local governments, with assistance from the.. How To Calculate Property Taxes In South Carolina.

From www.wikihow.com

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow How To Calculate Property Taxes In South Carolina here are the typical tax rates for a home in south carolina, based on the typical home value of $301,130. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Property tax is administered and collected by local governments, with assistance from the.. How To Calculate Property Taxes In South Carolina.

From www.steadily.com

South Carolina Property Taxes How To Calculate Property Taxes In South Carolina our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. beaufort county property tax calculator. This estimator is designed to give the. How To Calculate Property Taxes In South Carolina.

From www.wikihow.com

How to Calculate Property Tax 10 Steps (with Pictures) wikiHow How To Calculate Property Taxes In South Carolina beaufort county property tax calculator. the amount of property tax due is based upon three elements: to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes. How To Calculate Property Taxes In South Carolina.

From www.crgcompaniesinc.com

Property Taxes South Carolina Ranked 7th Lowest In The Country How To Calculate Property Taxes In South Carolina This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. beaufort county property tax calculator. our south carolina property tax calculator can estimate your property taxes based on similar properties, and show you how your. to calculate the exact amount of property tax you will owe requires. How To Calculate Property Taxes In South Carolina.

From www.pdffiller.com

Fillable Online How to Calculate Property Taxes Tipton County Fax How To Calculate Property Taxes In South Carolina This estimator is designed to give the taxpayer or prospective buyer an estimate of property taxes for a parcel of. beaufort county property tax calculator. the amount of property tax due is based upon three elements: (1) the property value, (2) the assessment ratio applicable to the. to calculate the exact amount of property tax you will. How To Calculate Property Taxes In South Carolina.